National Issues

Buhari: Accepting The Past, Facing The Future -By Magnus Onyibe

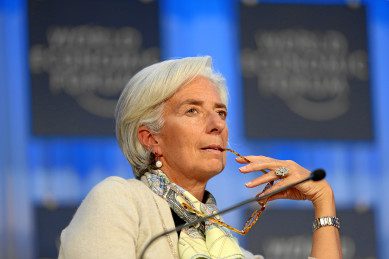

Managing Director of the International Monetary Fund, Christine Lagarde

The Managing Director of the International Monetary Fund, Christine Lagarde, was in Nigeria last week.

The last time the global financial intervention agency, the IMF, beamed its gaze on Nigeria (1985-6), was to convince the government to embark on financial reforms including devaluation of the naira.

I have heard many commentators lament that Nigeria’s economy is in dire straits similar to the situation in the mid-1980s compelling then army general, Muhammadu Buhari, to oust the democratically elected government of Shehu Shagari, which was accused of gross irresponsibility in governance, mired in monumental corruption and which consequently weighed down the country due to debilitating foreign debt.

Over 30 years after, one of the most vocal complainants and most dissatisfied persons about the dismal state of Nigerian economy is Buhari, now democratically elected president, who like many pundits are thumbing their nose at the rot in our society, not because they are unpatriotic, but for the palpable reasons that things have really gone south .

Amongst the justifications for their angst, and apart from the much vaunted mismanagement of Nigeria’s economy by the immediate past regime, are Boko Haram-induced insecurity in the North-East that has left a trail of sorrow, tears and blood in the past six or seven years with significant damage to the economy and society.

Even as the nation is struggling to wipe out the insurgents, a new separatist sect by the name of MASSOP or IPOB is threatening fire and brimstone, if they are not allowed to create their own country- Biafra in the South-East.

Handled with levity or without tact, it is capable of taking Nigeria down the same road it is travelling now with Boko Haram insurgency.

Before these new threats, a militant group by the acronym, MEND, agitating for control of the resources in the Niger Delta by the indigenes of the oil/gas rich region, had held the nation to a ransom, when oil workers were taken hostage and production/export of the commodity was on a lockdown. That was the situation until the late President Umaru Yar’Adua introduced an innovative solution of granting amnesty to the militants on the condition that they renounced violence and surrendered their weapons in exchange for comprehensive skills acquisition opportunities to facilitate their re-integration into the society.

This litany of unfortunate incidents narrated above represent the past tragedies which could have been better managed since they are within the scope of our leaders to so do, but having failed to address the issues constructively, they are now negatively impacting the future of Nigeria.

By far the most significant disrupter or is it influencer of Nigeria’s future is crude oil, which accounts for 40 per cent of the country’s GDP and about 80 per cent of her foreign exchange, FX earning.

With the commodity’s price plummeting from about $115 barely a year ago to the current price of less than $40 per barrel in the international market thereby shrinking Nigeria’s revenue by nearly 60 per cent, finding solutions to Africa’s largest economy’s woes has become more nerve wracking .

Unlike the case of insecurity arising from internal schisms earlier highlighted, Nigerian leaders have no control over oil price or the economic consequences arising from sharp drop in the price of the commodity.

Being an economy heavily dependent on oil revenue, one of the unpalatable fallout of the price crash is the situation whereby a majority of the 36 states of the federation are becoming insolvent and unable to pay civil servants wages and meet other social obligations to citizens .

As if the current misery is not harsh enough, it is being speculated that the price of oil will drop further in the next few quarters to about $20 by the estimation of the likes of Goldman Sach’s research team led by Jeff Curie and the IMF.

Should the foregoing proposition manifest, it will wreak more havoc on Nigerians because apart from the difficulties of payment of civil servants emoluments and wages, the private sector is also being starved of foreign exchange to purchase raw materials, spare parts and machinery to keep the wheel of industrial production turning to ensure that Nigerians are in gainful employment.

The resort to FX rationing to industries is owing to the fact that faced with dwindling income from oil/gas, Godwin Emefiele, as head of the Central Bank of Nigeria, in exercise of its statutory duties has listed 41 items as being ineligible for allocation of FX.

The action is part of a Herculean battle to maintain a stable exchange rate of the naira to international currencies in order to hold down inflation as naira comes under tremendous pressure such that the CBN is unable to supply FX to meet the greed as opposed to the need of some unscrupulous users.

To appreciate the level of abuse of FX demands by nefarious businessmen and women, we only need to cast our minds back to a former CBN governor, now emir of Kano, Lamido Sanusi’s lamentation a couple of years ago that a total of $16bn, split into $8bn apiece, was sold to fuel importers and applied in funding fuel subsidies respectively, in one year.

As the vocal former CBN boss further posited, Nigeria’s earning from crude oil export within the same period was $200m short of the over $16bn disbursed towards fuel import and subsidy which implies that Nigeria spent more money importing and subsiding fuel than she earned from the sale of crude oil.

It is against the backdrop of the foregoing economic dark cloud that the 2016 budget presented by Buhari to the National Assembly, to some Nigerians, is full of gloom, particularly because nearly N2tn of the estimated N6tn will be borrowed.

Remember the wise crack: “Those who go a-borrowing, go a-sorrowing.”

Although Lagarde has affirmed that Nigeria does not need the IMF intervention and avers that the Breton Wood institution is not in Nigeria to lend her money but to help build strong tax and debt management system, eyebrows are being raised in some quarters. The concern is underscored and magnified by the fact that Lagarde is calling for a relaxation of the tight monetary control introduced by CBN to stabilise the naira. Her request is by and large a call for naira devaluation; so, given that President Buhari had assured Nigerians during his maiden media chat that the naira would not be devalued, there is a need for government to explain the visit of the IMF to Nigerians.

In my assessment, IMF’s initiative to assist Nigeria build a strong tax and debt management system, is in consonance with the new government’s determination to track and trap all the financial leakages that had been afflicting the nation’s economy and which prompted the introduction of the Treasury Single Account which is said to have already yielded estimated N1.5tn into the CBN coffers.

Tellingly, on the tax front, the former head of tax administration in Lagos State, who was responsible for the phenomenal increase in internally generated revenue from a few billions to about N20bn monthly in the state, Tunde Fowler, has also been invited to Abuja to mount the saddle as the boss of the Federal Internal Revenue Service. This suggests that the Federal Government is more than ever, determined to capture all revenues that it is entitled to but hitherto allowed to seep away dubiously into private pockets under the watch of previous regimes.

In the light of the centrality of the need to seek alternative means of generating revenue since robust oil income has become elusive, it behoves on government to enlighten Nigerians who are wary of foreign loans, by making a connection between the TSA and the IMF which l reckon is expected to render technical assistance to Nigeria in the implementation of the TSA and facilitate more efficient and effective tax collection to boost government’s revenue earning capacity which is quite commendable.

Viewed from the prism of the stance of Nigerians against the IMF loan during the reign of Gen. Ibrahim Babangida, which toppled Buhari’s military regime, some 30 years ago, a thorough understanding of the role of the IMF in Nigeria by members of the public can not be taken for granted.

Keep in mind that Babangida initiated a public debate on whether Nigeria should take the IMF loan or not, resulting in Nigerians opting to say a resounding no and yes to a homegrown Structural Adjustment Program in 1986.

– To be continued

Onyibe, a former commissioner in Delta State, is an alumnus of Fletcher School of Law and Diplomacy, Tufts University, Boston, USA.