Economic Issues

Investor Education Is Critical To Retail Investor Participation In The Capital Market -By Boluwatife Falaki

In the digitalized world of today, financial markets, especially the capital market, play a major role in the development of any nation’s economy. Over the century, several nations have witnessed tremendous growth in their financial markets due to active participation of retail investors in the capital market. It is of a known fact that ‘’the size of a nation’s capital market is directly proportional to the size of the economy ‘’, of which the United States is a direct exemplary of this statement. According to investopedia (an online financial site), ‘’the United States of America has the largest economy, and the biggest capital market in the world’’; such feat could not have been achieved without the deep penetration, and participation of retail investors in its capital market.

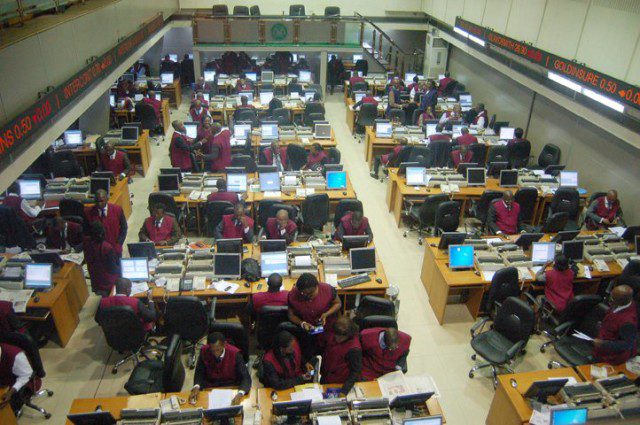

However, the reverse has been the case of Nigeria in terms of participation of retail investors in the capital market. ‘’The Nigerian Stock Exchange (NSE) has experienced high volatility due to the level of non-participation from domestic investors in the capital market’’; in fact, it is more worrying, and despondent that ‘’despite the huge population of the country, those who invest in the capital market are less than five million’’. The reason for this trend is not far fetched: low financial, and literacy education. Most domestic investors in Nigeria are not financially literate, which makes them to make uninformed, and erroneous decisions when buying, or selling financial securities in the capital market. The non-literacy cannot only be attributed to domestic investors alone, but even the common man hardly has any knowledge of what decisions are been made, how they are been made, and why they are been made. It is of a popular saying that ‘’90% of the people who trade without knowledge, and understanding of the dynamics will end up losing 90% of the capital most of the time’’, so all these statements all add up to convey the message that investor education is critical to retail participation in the capital market.

It is of no surprise to me that critics of investor education might say that what is the essence of putting certain structures in place to facilitate, and enhance the knowledge of retail investors when we already have a good number of the population participating, but they fail to realize that investor education has myriad of benefits, if introduced through the right mediums, channels, or agencies. One of the most prominent benefits of investor education is that it provides investors with the necessary tools to make informed, and better decisions. Through seminars, workshops, and weekly publications, investors will now have the right will, and power to make decisions that will result in the most productive outcomes for their investments.

In addition to providing investors with information, investor education increases the number of participants (retail investors) in the capital market. If participants are enlightened on the benefits of investing in the capital market, and the gains or profits that comes with putting their investment in the right channel that will maximize gains at the lowest possible risk, then, there will be an influx of more domestic investors trading in securities.

Moreover, it (investor education) increases investor confidence. Due to the fact that suppliers-retail investors-want maximum possible gains at the lowest possible risk, and users-corporations, institutions, government-want to raise capital at the lowest possible cost only goes a long way to increase the investors confidence that his investments are safe, and he is guaranteed maximum returns for his patronage of the company’s securities. As a result of heightened investor confidence, more local retail investors are willing to participate in the activities of the capital market, and contribute their own little bit towards the development of the capital market, and the nation’s economy.

Investor education also increases the volume of securities traded due to influx of retail investors into the capital market. It is very pragmatic to reason that if there is a high number of participants, and entrants into the capital market, the volume of securities traded will increase tremendously. According to This Day Newspaper, ‘’the value of securities traded increased from 355.2 billion in the first half of 2016 to 505 billion in 2017.’’ This increase can only be attributed to the degree at which investor education has permeated the capital market to galvanize, inform, and educate retail, and domestic investors to actively participate in the activities of the capital market. To give more logic of credibility to my argument, I would like to cite a recent development which has been employed by the Nigerian Stock Exchange to better empower, and educate its retail investors. The NSE recently launched a knowledge platform, X-Academy,’’ which provides training programme to equip individuals who will lead and transform businesses for sustainable growth.’’ The overall aim of the programme is to strengthen financial literacy and enhance investment in the capital market. To give this citation of mine weight, Mr. Ade Bajomo, the Executive Director, Market Operations and Technology, NSE, said in a press statement that, ‘’we executed over 200 free capacity building workshops aimed at enhancing investor understanding of the workings of the capital market. To further bolster his statement, he said that ‘’the multiplier effect of these workshops are phenomenal, as over 25,000 participating investors have been equipped to make better investment decisions’’. All these achievements, in addition to the investor clinic and education, make us see visibly that deep penetration of the capital market, and active participation can be achieved via investor education.

In conclusion, it is of no doubt that investor education is critical to retail investor participation in the capital market. I personally commend the work been done by the NSE(Nigerian Stock Exchange), but appeal that more can still be done through various channels such as signing of Memorandum of Understanding With shareholder associations, regular workshops, and seminars etc.

REFRENCES

(2017) ‘Deepening Stock Market Patronage Via Investor Education’, this day, Available at: https://www.thisdaylive.com/index.php/2017/09/20/deepening-stock-market-patronage-via-investor-education/ (Accessed: 12th October)

Sean, R. (February 23, 2016) ‘Capital Markets: Where They Matter Most’, investopedia, Available at: https://www.investopedia.com/articles/investing/022316/capital-markets-where-they-matter-most.asp (Accessed: 12th October)

Boluwatife Falaki,

C/o EducationUSA Advising Center

U.S. Consulate General

Lagos-Nigeria