Economic Issues

Lagos and pensioners’ welfare -By Bilikis Bakare

According to a famous American writer and producer, Gene Perret, “retirement is wonderful. It’s doing nothing without worrying about getting caught at it.” Ideally, the approach of retirement is supposed to be a phase of life to be savoured by all categories of workers, either in the public or in private sector. It is a period when a worker sits back to enjoy the fruits of the labour of his working days. Usually and majorly, these fruits are in form of gratuity and pension.

Pension is the benefit, usually money, paid regularly to retired employees or their survivors by private businesses and federal, state, and local governments. The pension system was introduced into Nigeria by the colonial administration and the first legislative document on pension was the 1951 Pension Ordinance, retroactively dated back to 1st January 1946.

This ordinance provided public servants with both pension and gratuity. It was meant to serve as a form of inducement and attraction for employment in the public service. The old pension scheme was a non- contributory one as it saddled the employers with the basic obligation of providing care for their employees on retirement.

But with the dwindling fortune of the nation’s economy coupled with various developmental projects jostling for attention and the growing number of retirees, the increasing burden of pension payment weighed heavily on government at all levels. In order to address this challenge, the contributory pension scheme was introduced in the Nigeria’s public sector in 1998.

In this scheme, both the employer and employee contribute a certain percentage monthly and were being managed by the Pension Commission. Marred with irregularities, the contributory pension scheme was improved upon in the Pension Reform Act 2004 and subsequently in 2014, through the Pension Reform Act 2014.The latter addresses and defines the custodian of these funds and assets as well as the overall management.

It is the realization of the challenges being encountered in the administration of pension funds as stipulated in the provisions of the Pension Act 2004 that the New Pension Act 2014 was passed by the National Assembly. It provides stiffer penalties intended to serve as deterrent against mismanagement or diversion of pension funds’ assets under any guise.

Under the new law, operators who mismanage pension funds will be liable, upon conviction; to not less than ten years imprisonment or five of an amount equal to three times the amount so misappropriated or diverted, or both imprisonment and fine.

The 2014 Act also empowers the Pension Commission (PenCom) – with the core mandate to ensure greater protection of pension fund assets- subject to the fiat of the Attorney General of the Federation, to institute criminal proceedings against employers who persistently fail to deduct and/or remit pension contributions of their employees within the stipulated time. This was not provided for by the 2004 Act.

Similarly, the Pension Reform Act 2014 has reviewed upwards, the minimum rate of Pension Contribution from 15% to 18% of monthly emolument, where 8% will be contributed by employee and 10% by the employer. This will provide additional benefits to workers’ Retirement Savings Accounts and thereby enhance their monthly pension benefits at retirement.

And in the event of loss of job, the waiting period for accessing benefits has been reduced from six months to four months. This is done in order to identify with the yearning of contributors and labour organizations.

Although adjudged as being better than the old method, the contributory pension scheme as stipulated in the Pension Reform Act 2004 was not without its challenges. These include the inability of the employers to honour their agreement by promptly remitting their own part of the fund, employment of unqualified staff to operate the pension commission office, non- prosecution of indicted officials in the mismanagement of these funds as well as the laborious protocol involved before accessing these funds after retirement.

Other challenges mostly on the part of the Pension Fund Administrators include, non- compliance of these administrators with investment limits, delay in the payment of retirement benefits, receipt of pension contributions without appropriate schedules and unresolved customer complaints among others.

Seeing retirees and the arduous tasks they undergo before collecting their hard earned benefits usually send jitters down the spine of those still in active service. Invariably, the period of retirement supposedly meant for resting and relaxation becomes the time for countless journeys to the pension commission office for one registration or the other.

Often, some retirees lose their lives either through road traffic accidents or via lack of resources to attend to age related ailments. One cannot overlook the rudeness of some of the pension commission staff and the corrupt practice of demanding for recharge cards from these old people whenever the need arises for them to provide the commission with information.

But by far the most outrageous ill- treatment these old people get is the mismanagement of the pension funds. Recently, some officials in the federal civil service were arraigned for diverting the pension funds to their personal use. Although sensationally reported in the media, the case like others of its kind seems to be unimportant.

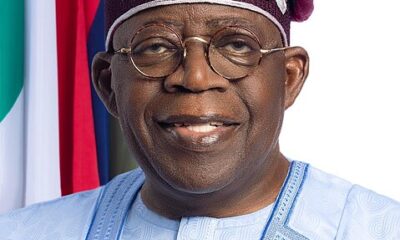

However, in the face of rampant cases of pension fund mismanagement across the country, the Lagos State Government having domesticated the Pension Act and signed it into law on 19th March, 2007, recently on the order of the State Governor, Mr. Akinwunmi Ambode, released the sum of N11bn to pay off pension liabilities owed the mainstream retirees and the retirees in Local Government Areas.

The development is part of efforts put in place by the present administration to find a holistic solution to the issue of payment of pension entitlements to retirees under the pay-as-you-go pension scheme, which was discontinued in April 2007, as well as outstanding accrued pension rights due to retirees under the contributory pension scheme.

In addition, the State Government has also painstakingly developed plans to disburse pension funds to ministries, departments, agencies and parastatals, including local government areas and State Universal Basic Education Board (SUBEB), monthly commencing from August 2015.

This intervention will go a long way in ameliorating the sufferings of retirees in the state and it is expected that other States in the Federation should take a cue from this gesture.

In all, if all the provisions of the new pension reform are strictly adhered to, then the retirees will be grateful to the government as enshrined in the words of Anglo-Irish novelist, playwright and poet Oliver Goldsmith: “O, blest retirement! Friend to life’s decline -How blest is he who crowns, in shades like thee. A youth of labour