Democracy & Governance

President Buhari and the Treasury Single Account (TSA)

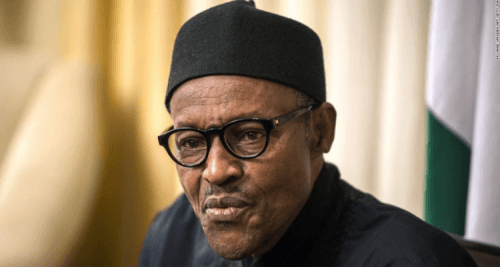

Muhammadu Buhari, Nigeria’s President.

Since his assumption of office on May 29, President Muhammadu Buhari has not left anyone in doubt that he is truly out to fight corruption as part of the change he promised Nigerians during his campaign. Most of his actions so far have clearly shown that we are certainly in an era of change, geared towards achieving a better Nigeria where it would no longer be business as usual.

The directive by the President that all revenues due to the Federal Government or any of its agencies must be paid into the Treasury Single Account or designated accounts maintained and operated in the Central Bank of Nigeria has been described by many as a welcome development. It is seen as one of the very good measures adopted by the current administration in its fight against corruption. We all know corruption is a cankerworm that has eaten deep into the fabric of our system and kept us in a terribly precarious situation that made Nigeria to look poor, despite the huge human and natural resources we are divinely blessed with.

According to Eze Onyekpere, the Lead Director of Centre for Social Justice, a civil society group based in Abuja, “The TSA is a process and tool for effective management of government’s finances, banking and cash position. In accordance with the name, it pools and unifies all government accounts through a single treasury account. The advantages and benefits of the TSA are legion. The consolidation into a TSA paves way for the timely capture and payment of all due revenues into government coffers without the intermediation of multiple banking arrangements…”

However, some fears have been raised about the policy. One of such major concerns raised as rightly noted by Peter Agada, a Lagos-based financial analyst, is the fact that it is going to negatively affect the activities of the commercial banks and this will, in his view, have a spiral effect on the entire Nigerian banking industry. The commercial banks as observed by another financial pundit based in Benin, Salihu Mohammed, may be left with no option than to downsize. It has even been reported that since the announcement, some commercial banks in the country have commenced the sacking of some of their workers on the excuse that they would no longer be able to maintain them, because of the massive withdrawal of funds by the agencies from their existing accounts in compliance with the government’s directive.

According to reports, the nation’s banks would be losing about N2 trillion deposits to the CBN, with the implementation of the TSA. This may have been the reason why bank treasurers, in countering the policy, had argued that the implementation would adversely affect liquidity in the banking system and end up putting pressure on interest rates and availability of credit to the economy.

Notwithstanding some of the worries raised against the TSA policy, most Nigerians seem to be pleased with its implementation. It is believed, as pointed out by John Ocheni, a Lokoja-based business entrepreneur, that scattering government funds in different commercial banks serves as a conduit for the perpetration of fraud by government officials in the MDAs. The thinking is that with this new method, leakages would be blocked and openness and accountability enhanced in the running of government businesses.

Justifying the order for the operation of the TSA, which is aimed at promoting transparency and facilitating compliance with sections 80 and 162 of the 1999 Constitution, the Permanent Secretary, Federal Ministry of Finance, Mrs. Anastasia Daniel-Nwobia, said: “The position of the constitution is that all revenues are supposed to go into the Federation Account. Before now, all agencies were allowed to generate revenue, use part of it to fund their operations and then remit the operating surplus to the Federation Account. But this act is a further confirmation of the Federal Government’s resolve that the provision of the constitution must be adhered to. And with all revenues going into a single treasury account, government will have an overview of the money it has in its account and better plan its expenditure. So, the leakages that used to be there in the system where people used money as they wanted and decided what to return to the government will no more be there. So, there is a better control and management of government revenue.”

In his reaction to the TSA policy, a development economist, Odilim Enwegbara, who commended the efforts of Buhari, said: “With the TSA leading to the closure of about 10,000 multiple bank accounts operated by the MDAs in commercial banks, banks will have to wake up from their slumber. This is because the era when government’s money is either lent back to government or invested in forex speculations is over. It also means that no longer at Bankers’ Committee meetings should member banks demand that the CBN pursues their self-serving high interest rates to their benefit and those of heads of the MDAs who placed public money in their high-interest-yielding fixed deposit accounts. With the TSA, government can easily quarantine its revenues, with intended consequences including forcing interest rates to naturally nose-dive, since no serious business should be ready to borrow at such double digit rates when the economy is struggling at between four and five per cent…”

The CBN governor, Godwin Emefiele, has repeatedly said there was nothing to fear about the movement of Federal Government funds from the banks to the CBN, insisting that it would not have any major negative impact on the liquidity conditions of the banks, contrary to widespread speculations. In his words, “The impact of the movement of funds from the banks to the CBN on liquidity is moderate. Nigerian banks are safe and healthy.” Emefiele added that the apex bank would continue to closely monitor the money market to ensure that the policy did not in any way affect the industry.

The Federal Government had set a deadline of September 15, 2015 for all the MDAs to comply with the new policy. The Accountant General of Federation, Alhaji Ahmed Idris, while giving an update on the exercise last Tuesday said the process was slow at the beginning owing to what he described as “teething problems.” The AGF noted that in spite of the challenges at the beginning, huge success has been recorded with the exercise.

According to him, out of the 900 MDAs, about 600 of them have so far fully complied with the directive on the TSA, while others were still at different stages of compliance. He said contrary to media reports that some MDAs were exempted from the exercise, no agency had been excluded from complying with the directive by the Federal Government.

It is important to note that the TSA issue did not start with Buhari. Former President Goodluck Jonathan had initiated the policy last year. But he could not implement it before he handed over to Buhari. The implementation deadline by Jonathan was fixed for February 28, 2015. This development, to me, is a purely clear indication that change has actually come. We must, therefore, endeavour to put sentiment aside and embrace this change as championed by Buhari himself to bring about a better Nigeria that we have all been clamouring for.

- Jegede, a journalist and public affairs commentator, wrote in from Abuja, 07065574368