Breaking News

Replacement of FIRS with NRS to Transform Nigeria’s Revenue System — Adedeji

Nigeria Revenue Service says replacing FIRS with NRS will modernise and digitalise revenue administration. Zacch Adedeji explains tax reforms, legal backing and fiscal goals.

The Nigeria Revenue Service (NRS) has said that replacing the defunct Federal Inland Revenue Service (FIRS) will fundamentally overhaul the country’s revenue administration framework.

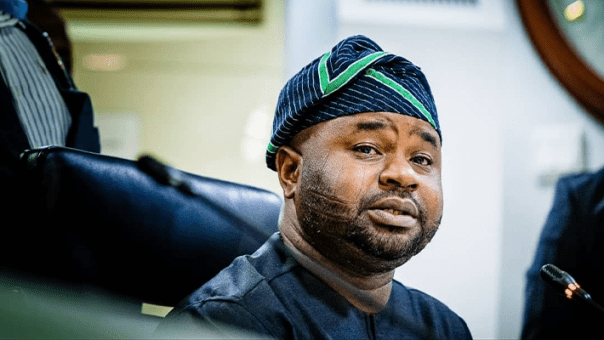

The Executive Chairman of NRS, Dr Zacch Adedeji, stated this during a television interview monitored in Abuja.

The News Agency of Nigeria (NAN) reports that provisions of the recently enacted tax reform laws renamed Nigeria’s apex tax authority from FIRS to NRS.

According to Adedeji, the creation of the NRS goes beyond a change of name, describing it as a comprehensive institutional reform.

“NRS is not branding. It is a total institutional upgrade moving from fragmented revenue administration to a modern, digitalised, centralised and intelligence-driven system.”

He explained that the new framework consolidates multiple tax and revenue-related functions that were previously dispersed across agencies, while placing greater emphasis on data integration, automation and reduced human discretion.

Adedeji also dismissed claims that the newly enacted tax reform laws were altered after being passed by the National Assembly.

“Only the officially gazetted Acts carry legal authority and are binding on taxpayers and administrators,” he said.

He noted that an Act of the National Assembly only becomes effective after presidential assent and official gazetting, stressing that the gazetted version is the authoritative reference in the event of disputes.

“Revenue agencies, courts, and taxpayers are therefore guided solely by the gazetted law, not draft bills, committee reports or chamber debates.

“Neither the executive nor the revenue authority has any incentive or legal capacity to alter the law after passage,” he said.

Adedeji added that the overhaul of the NRS is designed to support the Federal Government’s wider fiscal objectives.

According to him, Nigeria’s tax-to-GDP ratio has improved in recent years, reaching about 13.5 per cent as of October 2025.

“But it remains below the African average and well short of levels seen in peer emerging markets,” he said.

He said the core objective of the reforms is to focus taxation on profits and returns rather than capital or investment.

“We are not going to tax poverty; we want to tax prosperity,” he said.

Opinion Nigeria News