Nigeria has invested more than a decade in expanding financial inclusion through agent banking, digital wallets, and tiered KYC frameworks. The use of NIN as a...

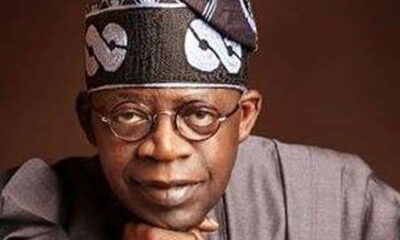

President Bola Tinubu insists Nigeria’s new tax reforms will commence on January 1, 2026, emphasizing economic benefits and legal integrity, while the PDP calls for suspension...

The Chartered Institute of Taxation of Nigeria (CITN) has also expressed concern over these discrepancies. The institute is calling for greater transparency and accountability in legislative...

The parasites in Nigeria have long been feeding fat on the host of a rentier state, and both must be dismantled. Those attacking Adedeji’s valiant efforts...

Taiwo Oyedele says Nigeria has under 10 million active individual taxpayers, stressing the need for data-driven tax reforms and highlighting Lagos’ ₦1 trillion property tax potential.

Former Senate Leader Ali Ndume has asked President Tinubu to delay the January rollout of the Tax Act and order a full investigation into allegations that...

The Nigerian Bar Association and former Vice-President Atiku Abubakar have urged the suspension of Nigeria’s new tax reform laws over alleged post-passage alterations, calling for investigations...

FIRS says Nigerians will use their NIN as Tax ID from 2026, while businesses will adopt CAC numbers, under the Nigeria Tax Administration Act.

The controversy began when Hon. Abdulsamad Dasuki, a member of the House of Representatives, claimed discrepancies between the versions of the tax laws debated in the...

Nigeria’s new tax rules are a step toward economic reform, but their success will ultimately be judged by their impact on the country’s most dynamic economic...