National Issues

Will Natural Gas Take The Straw Away From Those Drinking Our Fuel? -By Khaleb Ogbonna

With the near-depletion of disposable income for the average Nigerian and a rising poverty rate – Nigeria being the poverty capital of the world – the argument is not whether subsidies will continue or not, nor is it about whether we are in the age or decade of gas. The focus now should be on how swiftly this policy can be implemented to ensure Nigerians spend less on energy consumption. The current fuel subsidy has driven expenses on energy and production to an all-time high, not to mention the grating impact of inflation as well.

As seen in a viral video on social media, a few young men – probably members of a transportation union in one of the Francophone African countries – are seen lamenting and criticising Nigeria’s President, Bola Ahmed Tinubu, for his removal of fuel subsidy.

Fuel queues in Abuja, Nigeria’s capital.

Based on a slight understanding of the figures mentioned in the said video, in a mixture of the languages they spoke, French and Fulfulde, there is an apparent increase in the price of the commodity that they used to get cheaper and more easily before. The price of the heavily subsidised Premium Motor Spirit (PMS), which sold for less than 450 CFA in Nigeria’s neighbouring countries of Chad, Cameroon, Niger, and Benin, had risen to over 800 CFA, a whopping 77.8% increase.

NIGERIA’S FUEL CONSUMPTION RATE

In a viral video during the run-up to the 2023 general elections, the candidate of Nigeria’s Labour Party, Mr. Peter Obi, while making a case for the removal of the subsidy on petrol, compared Nigeria’s consumption to that of Pakistan with a similar population density but a higher number of cars. In his comparison, Nigeria’s overblown consumption raised the question of who has been consuming the excess fuel.

According to a report, Nigeria, a country with a population of about 200 million, consumes 66.8 million litres of petrol daily. However, this conflicts with the report by the Nigerian Customs Service, which accused the NNPC of releasing over 90 million litres. This, however, is not far from a statement made by Mr. Melee Kyari, the Group CEO of the Nigerian National Petroleum Company Limited (NNPC), in an interview on Arise TV. He alluded to this and explained that when a marketer hauls a full tanker to the North for sale, profit margins could be around NGN 250,000. However, when taken across the border, the subsidised petrol can generate a profit of over NGN 30 million.

According to the NNPC’s own admission, over 20 million liters of petrol are smuggled outside Nigeria daily. The sale of smuggled petrol across the West African sub-region fuels black markets and distorts the price mechanisms of these countries.

According to a report by the International Monetary Fund (IMF), Nigeria spent NGN 1.89 trillion out of NGN 4.98 trillion (39%) generated from oil revenue on subsidies in 2021. In 2022, it rose to NGN 4.6 trillion out of NGN 7.5 trillion (61.4%). Then in 2023, the projection stayed at NGN 3.14 trillion out of NGN 9.41 trillion.

This is scary, yet not as scary as a deeper revelation that this uncovers. The World Bank reports that out of the money spent on fuel subsidies, the poorest 40% of Nigerians purchase just 3% of all subsidised petrol. To put it simply, over 80 million Nigerians buy 1.9 million litres out of the 66 million litres released daily. So, by this analogy, the people consuming the fuel are those who are benefiting from the 20 million litres of PMS already paid for, along with a small population of 120 million privileged Nigerians who consume the rest.

This public spending is troubling. When compared to the ratio of public spending to GDP, developed economies average 30% compared to Nigeria’s 13%. However, what is more troubling is that Nigeria’s government expenditure ranks quite low globally. Nigeria spent an average of $23 on education per Nigerian, compared to $32 in Mali, $88 in Ghana, and $350 in South Africa.

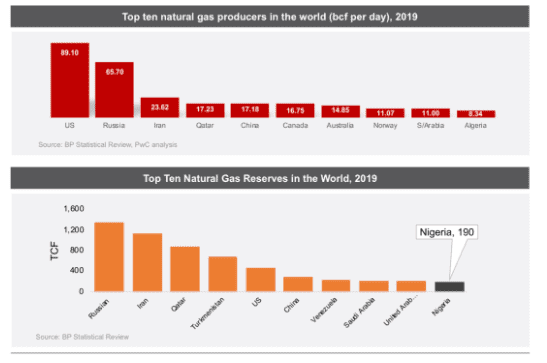

THE DECADE OF GAS

In December 2020, the then-president of Nigeria, Muhammadu Buhari, declared 2020-2030 as the “decade of gas” for Nigeria with the signing of the Auto-gas Policy. The idea behind this declaration was that for a country with over 200 trillion cubic feet of natural gas deposits, it was necessary to move Nigeria away from its over-reliance on petroleum products like fuel, which have been the mainstay of the country’s energy consumption.

Muhammadu Buhari, Nigeria’s president (2015-2023)

With several policies and targeted investments in the oil and gas sector, such as the unbundling of the NNPC to a Saudi ARAMCO-esque limited liability company, the Buhari administration followed up with the approval for the construction of the AKK project. This is a 614 km natural gas pipeline that will transport over 3.5 trillion cubic feet of gas daily from Ajaokuta to Kano through Kaduna. The project is said to be about 45% completed.

However, the question for the average Nigerian energy consumer is how these policies and projects will affect them. The primary objective of the auto-gas policy is to reduce dependence on petrol and diesel and to make a 40% switch to natural gas products like Liquefied Natural Gas (LPG) and Compressed Natural Gas (CNG) within the decade. This shift will require the country to explore its gas potentials to the fullest.

CNG AND LPG TO THE RESCUE

In moving towards alternative natural gas products, there is a general consensus, echoed during the Buhari administration, that natural gas offers a cheaper way out of the expensive regime of fuel that necessitated government subsidies.

In an interview with Business Day, Kelvin Emmanuel, an energy sector expert and co-founder/CEO at Dairy Hills, provided a breakdown of the price difference, stating that “One standard cubic metre of CNG ranges between N175-N270 depending on location. That means it is 30 percent the price of diesel and 41 percent the price of petrol from the top line.”

With the near-depletion of disposable income for the average Nigerian and a rising poverty rate – Nigeria being the poverty capital of the world – the argument is not whether subsidies will continue or not, nor is it about whether we are in the age or decade of gas. The focus now should be on how swiftly this policy can be implemented to ensure Nigerians spend less on energy consumption. The current fuel subsidy has driven expenses on energy and production to an all-time high, not to mention the grating impact of inflation as well.

CONVERSION OF PETROLEUM AND DIESEL ENGINES TO CNG AND LPG

With the need for cheaper alternatives, there is a necessary shift towards converting petrol-powered engines to CNG or LPG. The government took the lead in this effort when Minister of State for Petroleum Resources, Timipre Sylva, ordered the chief executives of departments and agencies under the Federal Ministry of Petroleum Resources to convert all their official vehicles to run on autogas. In the pilot phase, the Federal Government planned to finance the conversion of one million vehicles from petrol to natural gas. These vehicles, mostly passenger and haulage vehicles on Nigerian roads, were expected to be converted by the end of 2021.

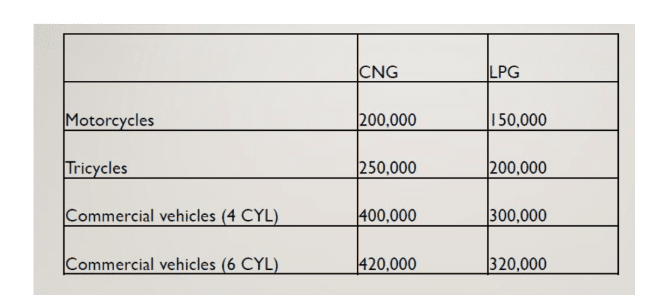

CONVERSION COST

Source: Africa Oil and Gas Report

Despite the declaration of the decade of gas, it is disheartening to observe that the federal government allocated a meagre amount in its 2023 budget for this purpose. The cost of purchasing the kit required to convert a car from a petrol or diesel engine to a CNG engine ranges from N100,000 to N300,000, depending on the nature and condition of the car. However, a fully converted car can save over 40% of its energy budget.

MAJOR PLAYERS IN THE GAS INDUSTRY

While the conversion from fuel and diesel-driven engines aims to alleviate the energy crisis caused by over-reliance on fuel and diesel, it is necessary to address the issue of revisiting the fuel subsidy merchants who held the country hostage during the days of subsidy payments.

Top ten natural gas producers in the world

Although the government has stopped the payment of subsidies, the Nigeria Liquefied Natural Gas (NLNG) Limited, operating at only 10% capacity due to infrastructure challenges, provides 50.1% of the required gas. Analysis of data from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) shows that eight firms imported 311,521.22MT (49.9%) of cooking gas between October 2021 and March 2022 from countries such as the USA, Equatorial Guinea, Belgium, and Argentina. However, 312,752.24MT, representing 50.1% of the domestic market supply, was obtained locally from the Nigeria Liquefied Natural Gas (NLNG) in Bonny, Rivers State, and BRT LNG.

The above indicates that moving away from subsidy payments without a simultaneous commitment to rid the country of influential individuals in the energy sector who previously determined the price of petroleum products poses another danger. Nigeria needs to invest more in realising its gas potential. Only then can it be said that the straw is removed from the mouths of those drinking our fuel.

Khaleb Ogbonna is a media executive who can be reached at Khalebpowers@gmail.com.