Breaking News

CBN clears additional verified forex liabilities backlog and distributes $500 million

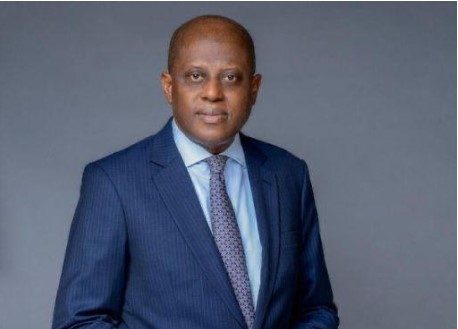

Reiterating the assurances of the Governor, Mr. Olayemi Cardoso, Sidi Ali said the CBN had begun implementing a comprehensive strategy to improve liquidity in the Nigerian foreign exchange markets in the short, medium, and long term.

In an effort to alleviate the backlog of confirmed foreign exchange (forex) transactions, the Central Bank of Nigeria (CBN) has issued $500 million to various industries. This comes just a week after the Bank paid almost US $2.0 billion to fulfil outstanding commitments in the manufacturing, aviation, and petroleum sectors.

The Acting Director of the Corporate Communications Department at the CBN, Mrs. Hakama Sidi Ali, stated this in Abuja on Monday, Janaury 29.

She noted that the Management of the CBN was committed to settling all legitimate forex backlogs within a short time frame.

Reiterating the assurances of the Governor, Mr. Olayemi Cardoso, Sidi Ali said the CBN had begun implementing a comprehensive strategy to improve liquidity in the Nigerian foreign exchange markets in the short, medium, and long term.

Benefits

“As the Governor said, the CBN’s focus is on addressing fundamental issues that have hindered the effective operation of the Nigerian forex markets over the years,” she added.

Sidi Ali noted that the forex market reforms were designed to streamline and unify multiple exchange rates, foster transparency, and reduce arbitrage opportunities.

She expressed confidence that a stable exchange rate would boost investor confidence and attract foreign investment.

She, therefore, urged all participants in the market to play by the rules. She aslo stressed that transparency in the market would enable the fair determination of exchange rates and, by extension, guarantee stability for businesses and individuals alike.

Recall that the CBN, over the past few months, has released various sums in its effort to clear the backlog of foreign exchange liabilities.