National Issues

Fraud, Ponzi Schemes and Terror Financing: A Story About Banking In Nigeria -By David Hundeyin

What is more, these were not stories about a few “bad eggs” in the Nigerian banking sector. Pretty much all of Nigeria’s major banks were implicated, albeit to differing extents. In the interest of brevity, an editorial decision was made to tell the 4 most disturbing stories in no particular order.

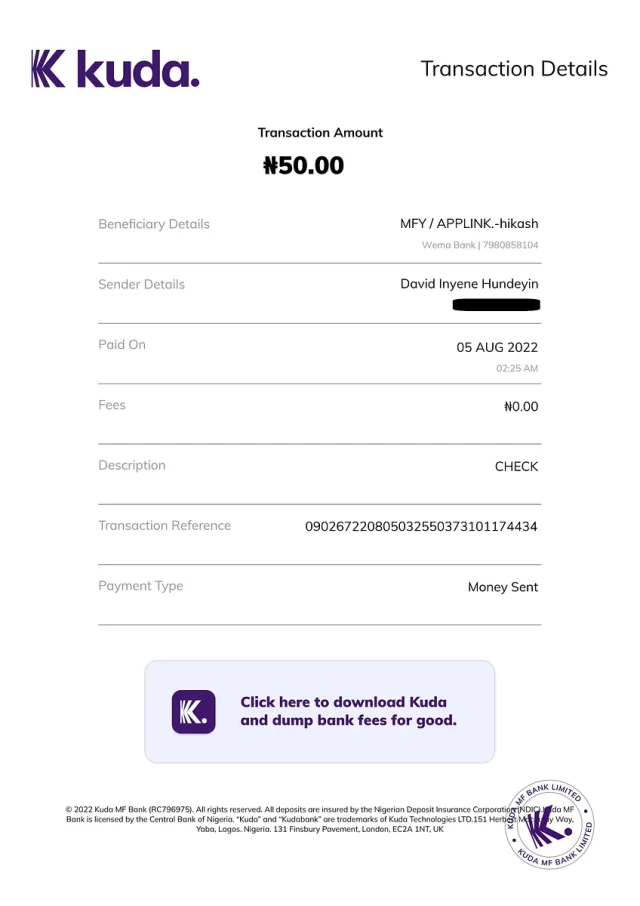

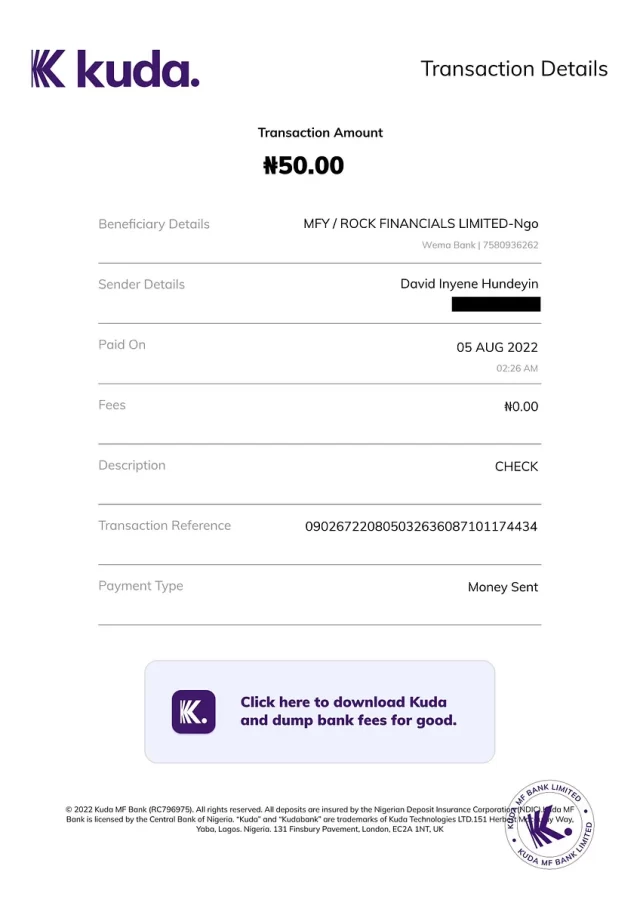

In May 2022, shortly after my story about Chinese loan sharks in West Africa went up, a number of new tips and leads started trickling in. It looked at first, as though a follow-up story would emerge, focusing on how some Nigerian banks still offer banking services to illegal loan sharks despite CBN regulations expressly forbidding this. Wema Bank – unsurprisingly – was the most regular offender in this category, lending its support to multiple illegal loan sharks up until as recently as the time stamps in the images below.

As I trawled through the leads and my own mounting pile of untold story ideas sitting on my Google Drive however, I started to realise something – there was a much greater issue at play here than a few banks bending KYC rules to bank some customers that ought not to be banked. These were borderline unbelievable stories – stories about aggressively fraudulent behaviour by Nigerian banks presented with evidence that was as devastating as it was undeniable.

What is more, these were not stories about a few “bad eggs” in the Nigerian banking sector. Pretty much all of Nigeria’s major banks were implicated, albeit to differing extents. In the interest of brevity, an editorial decision was made to tell the 4 most disturbing stories in no particular order.

There is a story about collusion with regulators to cheat customers and brazenly steal their property. There is a story about illegal, unauthorised account openings which potentially expose customers to an entire world of pain and liability. There is even a story about brazen collaboration with ponzi schemes and illegal investment programs.

Most alarmingly, there is a common denominator of regulatory weakness and complicity, if not outright collusion across all the stories, which culminates in a story about inflows from Qatar potentially financing terrorism in Nigeria for well over a decade. While working on this story, I reached out to no fewer than 6 financial institutions and regulators who were implicated in the maze of documents and testimony I went through.

As always, they had nothing to say.

WEMA, UBA And The Unwanted Accounts: Nigeria’s Wells Fargo Moment?

In 2016, a scandal broke out at Wells Fargo Bank, which at the time was the world’s largest bank. It emerged that over 3.5 million accounts had been secretly opened for customers without their knowledge and authorisation, in response to unrealistic in-house sales and marketing targets. Staff were incentivised to open as many accounts for their customers as possible, and the bank knowingly looked the other way when basic KYC protocols such as customer permission were breached.

In response to the scandal, Wells Fargo fired over 5,000 employees and paid over $3 billion in penalties under a settlement announced by the US Justice Department in 2020. Given the amount of damaging publicity the scandal received, it became an opportunity for banks and banking regulators around the world to review and tighten their operating practices to avoid getting caught up in a similar mess. In Nigeria however, it was treated not as a cautionary tale, but as inspiration for a potentially even bigger brewing scandal.

From May 2022 for example, hundreds of tweets like this began appearing:

Read full article: West Africa Weekly