National Issues

What Nigeria Can Learn from Ghana’s National Health Insurance Scheme -By Oreoluwa Olukorode

Ghana is considered one of the first African countries to implement a tax-funded health insurance scheme which now has the highest coverage rate in the continent. Policy experts often tout this scheme due to its financial sustainability mechanisms; from the cost containment strategies put in place to its risk pooling system.

A well-functioning, accessible, and resilient healthcare system is considered one of the key indicators of the strength of a country. The COVID-19 pandemic was enough proof that medical emergencies are unpredictable and can put families and individuals in significant financial hardship, especially those with lower incomes. As a result, health insurance has become a crucial strategic focus for health systems across the world, especially in Africa. Besides, the rising cost of medical services has left billions of people unable to afford basic healthcare. Let us face it, health insurance is a safety net, and we’ve seen that people who have access to it are more likely to experience better health outcomes than those who do not.

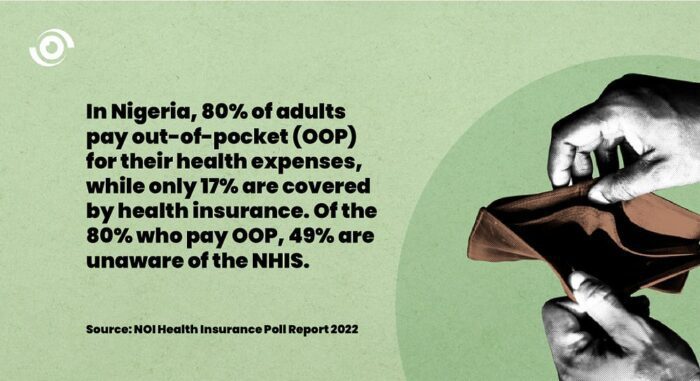

In Nigeria, where the NHIS covers just a small percentage of the formal sector, with little to no coverage for those working in the informal sector and even the vulnerable population, most people are deprived of accessing quality healthcare. For this reason, the Nigerian government signed the new National Health Insurance Act into law on May 19, 2022. It makes health insurance mandatory for all citizens and plans to expand coverage to over 83 million poor and vulnerable people.

While this is not the first noteworthy pursuit of the National Health Insurance Scheme-now Authority-since its establishment, for it to be successful, there has to be a collaborative effort between the Health Reform Committee, the State Governments, the Federal Ministry of Health and the National Health Insurance Authority. It is also important to take lessons from African countries that have successfully implemented National Health Insurance and are on their way to achieving universal health coverage.

Ghana is considered one of the first African countries to implement a tax-funded health insurance scheme which now has the highest coverage rate in the continent. Policy experts often tout this scheme due to its financial sustainability mechanisms; from the cost containment strategies put in place to its risk pooling system.

In 2021, it was reported that nearly 70% of the population in Ghana was covered by either the National Health Insurance Scheme (NHIS) or private health insurance schemes, 19 years after its establishment. The scheme is decentralised into a Private Mutual Health Insurance Scheme, Private Commercial Insurance Schemes, and District Mutual Health Insurance Scheme (DMHIS), the latter being the most common. The strength of this scheme lies in its various financing mechanisms where individuals, employers, the government, development partners, and donor organizations contribute appropriately.

For individuals, only informal sector workers pay monthly premiums to the NHIS while formal sector workers contribute a fixed percentage of their monthly income to the scheme. Employers are required to register their employees and pay a contribution towards their health insurance coverage. The government, as the main driver of this scheme, provides funding through the National Health Insurance Levy (NHIL). The NHIL forms 3.5% of all Value-Added Tax (VAT) on goods and services. This is the largest source of revenue for the NHIS and it covers pregnant women, differently-abled persons, children, people above 70 years, persons with mental disorders, and pensioners.

What is Ghana doing differently?

There have been several innovations and initiatives in the Ghana NHIS which could be a great source of inspiration for the Nigeria NHIS that is undergoing necessary change.

Here are a few examples:

- Mobile Renewal: the Ghana NHIS introduced a mobile renewal service that allows subscribers to renew their membership and pay premiums through their mobile phones. This has made it easier and more convenient for enrollees, especially those in the informal sector, to renew their membership without having to physically visit NHIS offices. This is a win for both enrollees and NHIS staff who now have more time to focus on other responsibilities. While some states in Nigeria have explored this initiative, the NHIS as a whole can implement this and work towards simplifying its enrolment process to make it more accessible to the general population.

- Claims Processing System: a claim is a financial demand made by the healthcare provider on behalf of the insured from the insurance company after providing medical treatment or services, if only the claim is legitimate and within the provisions of the insurance policy. Ghana NHIS implemented an electronic claims processing system that has streamlined the payment process and reduced the time it takes for healthcare providers to receive payments for services rendered. This system helps the government keep track of prevalent diseases in the country and also, establishes transparency with healthcare providers. In Nigeria, HMOs receive payments or premiums from the NHIS, individuals, companies, or groups and are supposed to remit funds to providers over 30 days. However, a major issue Nigerian healthcare providers face is a delay in payment from these HMOs. With Claims Processing Software, payment is automatically initiated by the healthcare provider to the HMO with details on the health services a patient received and the associated charges set by the doctor or facility, thereby making the process more transparent, especially for the NHIS to monitor.

- Effective communication: establishing a national health insurance scheme is one thing while encouraging people to enroll in it is another matter entirely. A study showed that when people have a clear understanding of how health insurance works and what it covers, they are more likely to see the value in subscribing to it. Therefore, individuals and families must understand the benefits and importance of having health insurance coverage, including the various insurance plans, the coverage they provide, and the costs associated with them. The Ghana NHIS has been successful in communicating its services and benefits to the public through community outreach programs, mass media campaigns, and partnerships with key community stakeholders. A few states in Nigeria are also actively sensitizing the public on the health insurance packages that are available. For example, in Lagos state, apart from community sensitization programs, a talent hunt was organised by LASHMA to inspire young people who are interested in showcasing their creativity. The winners were adequately rewarded and at the end of the campaign, the Agency saw an increase in enrollment. Other states can learn from this and improve their awareness strategies.

- Adequate funding: one of the key factors that have contributed to the success of the NHIS in Ghana is adequate funding. Compared to other sub-Saharan countries, Ghana spends a relatively higher percentage of its Gross Domestic Product (GDP) on health. Likewise, the budgetary allocation to health is 10.6% of the total government expenditure, which is closer to the Abuja Declaration target of 15%. The Ghanaian government has also consistently provided the NHIS with sufficient financial resources by pooling funds from various sources for years now. This simply shows the impact of adequate political will in achieving health for all. The Nigerian government should learn from this.

- Strengthened primary healthcare: Ghana has made significant progress in improving its primary healthcare system in recent years. There are various initiatives (in partnership with the NHIS) targeted at remote areas to deliver free and quality primary healthcare to individuals and households. In the end, it comes down to upscaling the primary healthcare system in Nigeria to increase access to healthcare services, particularly for those who may not have the resources or ability to travel to a specialist or private hospital.

- Improved Monitoring and Evaluation: from conducting customer satisfaction surveys to regular quality assurance assessments, the NHIS in Ghana monitors the performance of healthcare providers and uses data collected to identify parts of the scheme that need improvement. The monitoring process involves ensuring adherence to treatment guidelines, which entails identifying any anomaly and conducting surprise visits to facilities to randomly verify provider claims. The governance of the NHIA in Nigeria should prioritize monitoring providers, HMOs, and third-party administrators, and also ensure that the already existing regulatory framework is strictly adhered to. To further build the trust of members, the NHIA could release quarterly reports evaluating the impact of the scheme, as well as areas for improvement.

Overall, Nigeria is actively working towards attaining universal health coverage, with significant efforts being made in that direction. The National Health Insurance Authority can learn from the successes of Ghana to improve its operations and increase access to healthcare services for the population.