National Issues

Issues Arising On The Revenue Allocation In Nigeria’s Federalism -By Famakinde Olusogo Michael Esq.

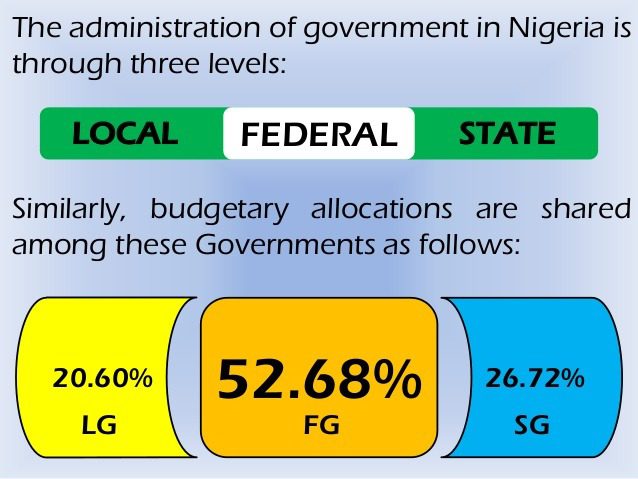

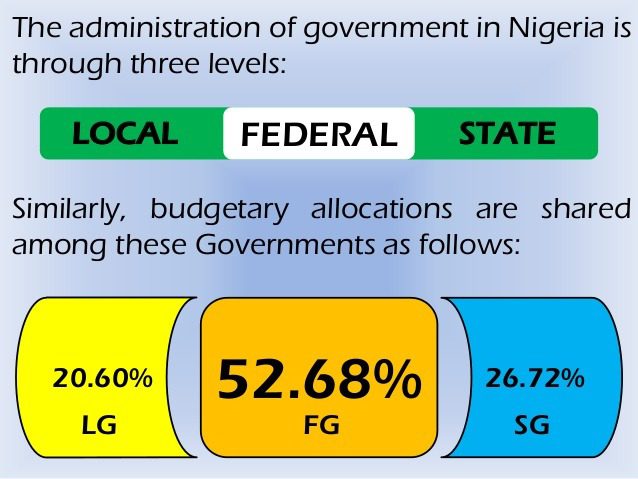

The issue of the revenue sharing formula in Nigeria has, over the years, been a bone of contention. Arguments have been raised accompanied by diverse suggestions, standpoints and recommendations from different minds. Of the many arguments and recommendations, a content that is common is the need to cut down the percentage allocated to the Federal government as the percentage is perceived, by many, as being too humongous.

Recently, someone even suggested that the current allocation of 52.68% accruable to the federal government should be allocated to the local governments. In his words, because local governments are for the development of the grassroots level.

However, it should be noted that _that_ particular suggestion is highly unrealistic because it presumes the federal government does not have any responsibility whatsoever. If the concentration is totally directed towards the grassroots development, what should happen to all the functions listed for the federal government? Does it mean all the functions of the federal government should be handed over to the local governments?

Nonetheless, I also advocate for a reduction in the percentage accruable to the federal government and my recommendations are 38%, 32% and 30% for the federal, state and local governments respectively.

A number of considerations led to my coming up with these recommendations. One of which is the density of the responsibilities spelt out for the federal government in the “Exclusive Legislative List” contained in the Part 1 of the Second Schedule of the 1999 constitution of the Federal Republic of Nigeria. The list that contains not less than 68 items which include Arms, ammunition and explosives, External affairs, Defence, Diplomatic, consular and trade representation, census, creation of states, immigration and emigration etc. can still be best handled by the federal government with delegations for some at the state level.

Another consideration is the element of equality. Nigeria, at least in theory, is a federal state and if the spirit of federalism will truly be exhibited, there is a need to consider Even development alongside any other consideration. However, if at all there will be a difference, it should be so minimal that it will be almost imperceptible which puts the difference between the federal government and state government at 6% and 2% between state and local governments.

All in all, all levels of government should learn to improve their sources of internally generated revenue so as to be less dependent on the allocation from the federation account. Also, the abolition of the ‘State Joint Local Government Account’ as contained in the Section 162 (6) of the same working constitution in Nigeria should be implemented.

Famakinde Olusogo Michael Esq.