Economic Issues

Currencies Redesigning And 1984 Experience -By Ibrahim Mustapha Pambegua

There is the need for the EFCC to deploy its officers to various banks to keep vigil on those moving with sacks filled with questionable funds. The apex bank should also embark upon enlightenment and sensitisation programs through mass media to avoid the repeat of 1984 experience where millions of Nigerians could not change their old notes.

The governor of central Bank of Nigeria, CBN, Goodwin Emiefele, recently announced the plan of the apex bank to redesign 1000,500 and 200 notes, distribute and circulate them on 15 December this year. The old ones will continue to be used as legal tender until January next year when they cease to be acceptable as a medium of exchange. The policy has continued to generate debate among the economist and financial experts. The last time Nigeria redesigned its currencies was in 1984. While the timing of the redesigning may be wrong, particularly few months to the general elections, the reasons adduced by Emiefele has became imperative for the policy. If above 80 percent of currencies in circulation are outside the banking vaults as affirmed by him, it means the country’s economy is in trouble. The objectives of currencies redesigning as stated by the CBN governor are to have clean naira noted, recover elicit funds, tackle insecurity and above all address the menace of currencies counterfeiting.

However, opponents of the policy are quick to pick hole and conclude that, the move will inflict more harm to the ordinary Nigerians instead of addressing the concern raised by the authority. Some Nigerians with old memories expressed fears that the attempt to redesign the currencies reminiscent the 1984 when Buhari military government changed the nation’s currencies and gave short notice to Nigerians to exchange them. At the end of the exercise, ordinary Nigerians with little saving could not be able to change their currencies leading to lost of millions of naira . Also, many business people with legitimate saving lost their hard-earned currencies. The poser begging for answer is: will this one be different from the 1984 experience? While In 1984 the banks assigned for the receiving of deposits were few, today we have many banks scattered across the nook and corner of the country that can facilitate the success of the exercise. With the introduction of electronic banking such as point of sale (POS), Nigerians can deposit their money at their convenience. The three months period granted for the exercise seems good unlike the one week short notice of 1984 which marred the success of the exercise.

One doubts, if the current efforts to redesign the currencies will nip into bud the hyperinflation and deteriorating insecurity bedevil the country as stated by Emiefele. Nigerians are currently experiencing high cost of living due to inflation. No sooner the CBN governor announced the new policy, the price of dollars and other foreign currencies skyrocketed in the parallel market. The rise of price of dollars will put more pressure on our devalued naira and affect the prices of some good being imported to the country. There is also panic in the country as those who illegally acquired funds have started investing them in estate and other lucrative business. Although, the anti-graft agency such as EFCC has

promised to monitor lodgement of elicit funds into the banks by suspected fraudsters and launderers, some bankers are actually complicit in aiding corruption through conniving and keep silence on the huge amount of money launder. There is the need for the EFCC to deploy its officers to various banks to keep vigil on those moving with sacks filled with questionable funds. The apex bank should also embark upon enlightenment and sensitisation programs through mass media to avoid the repeat of 1984 experience where millions of Nigerians could not change their old notes.

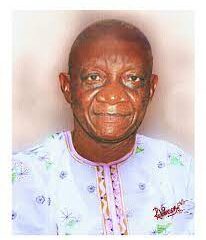

Ibrahim Mustapha Pambegua, Kaduna state. 08169056963