Legal Issues

Legal Analysis Of The E-tax Payment System In Nigeria -By Oyetola Muyiwa Atoyebi & Obiora Ifediora

Government has started several reforms and innovations to increase the collection of internally generated revenue, with taxation receiving the majority of attention.

INTRODUCTION

Nigeria’s economic growth has become increasingly reliant on oil exports and such reliance can no longer be sustained due to the drop in oil prices, which has been the norm for some time now. Therefore, the government at all levels are turning their focus inward to support their public spending.[1] The government has started several reforms and innovations to increase the collection of internally generated revenue, with taxation receiving the majority of attention. This article delves into the legal framework underpinning the e-tax payment system, examining the relevant laws, regulations, and policies governing its operation. It further explores the rights and obligations of various stakeholders, the protection of taxpayers’ data, and the mechanisms in place for dispute resolution.[2]Through this examination, it is aimed that a better understanding of the legal aspects of this transformative technology, facilitating informed discussions and potential improvements in Nigeria’s tax administration will be provided.[3]

MEANING AND EVOLUTION OF E-TAXATION IN NIGERIA

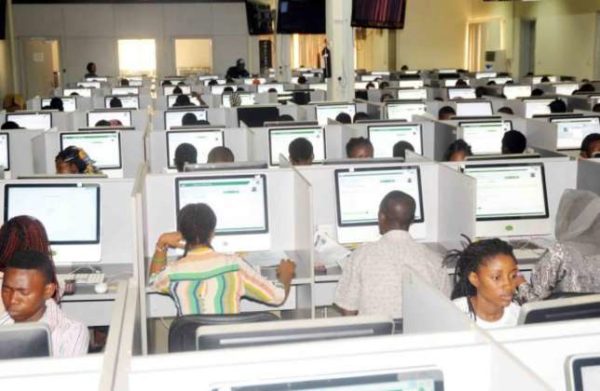

E-taxation refers to the use of electronic media by government representatives for tax administration, assessment, and collection. It refers to the use of information and communication technology by the majority of governments around the world to enhance the administration of public services and accountability.[4]This platform allows taxpayers to access all government services related to tax payment, such as registration, return filing, tax payment, and tax clearance certificate requests, online.[5]Nigeria’s Federal Inland Revenue Service’s implementation of an electronic taxation system serves as a useful illustration.

In contemporary times, e-filing of tax returns was the first step toward the introduction of e-taxation, which was first done in the USA in 1986 and Australia in 1987. While Malaysia, the Netherlands, and Uganda introduced electronic tax payments by revenue authorities and taxpayers in 2009, Egypt started accepting electronic tax payments in 2013 in order to keep up with the automated payment systems used by the government for its foreign trade transactions.[6]

Nigeria joined the league in 2015 when its tax authorities attempted to automate its tax system in cooperation with Nigerian Inter Bank (NIBSS),[7]in order to improve tax administration, collection, and collection costs. E-taxation in Nigeria promises to replace manual return filling, process tax assessments more quickly, cut expenses, and boost efficiency.[8]

OBJECTIVES OF E-TAXATION SYSTEM

E-taxation, which replaces the manual tax system by simplifying tax compliance, facilitating access to tax services, and enhancing the tax payment process, was introduced in 2015, as widely publicized by FIRS through its press releases. In essence, e-taxation was implemented to accomplish the following goals:[9]

- To address the issues bedeviling Nigeria’s outdated manual taxation system.

- To offer streamlined, effective procedures that make it simpler for taxpayers and other stakeholders to interact with the service and, as a result, increase the FIRS’s responsiveness to the needs of taxpayers.[10]

- To increase taxpayers’ willingness to pay taxes voluntarily and to make the tax-paying community in Nigeria more welcoming.

In line with the objectives of e-taxation system, the Company Income Tax Act (CITA), Value Added Tax Act (VATA), the Personal Income Act (PITA), the Capital Gains Tax Act, the Petroleum Industry Act 2021 are some of the primary tax legislations in Nigeria and they include provisions relating to the assessment and payment of tax, allowing for the electronic filing and payment of taxes.[11]The FIRS also may at intervals issue guidelines and circulars to provide further details on e-tax payment procedures.

BENEFITS OF E-TAXATION IN NIGERIA

The paradigm shift from a manual system to e-taxation by the FIRS and other states revenue authorities has been hailed as an outstanding achievement because it will greatly benefit both taxpayers and tax administrators. The e-tax system is already being used by taxpayers, in places such as Lagos, Abuja, Enugu, Oyo etc., although it has not yet been fully implemented in several others.[12] According to FIRS, it has provided answers to some of the problems with the manual tax system.[13]Among them are;

- As a result of the new e-tax system, paying taxes is now simpler. The length of the tax processes can be shortened by filing returns and paying taxes from the convenience of the taxpayer’s home. The tax authorities and the taxpayer can now communicate more easily and online. Due to the ease of tax payment, compliance with the law is now strongly advised.

- With the e-tax system in place, the problem of subpar tax administration is now history. Once more, there is no need for a lot of manpower, and less resources are being used for tax administration.

- Furthermore, there is enhanced communication and the ability for tax administrators to concentrate on other areas that will improve the economy.[14]

- The new system exposes taxpayers and administrators to new cutting-edge technology, enhancing their expertise in tax-related matters. E-tax systems have emerged to fill the gap left by the manual system’s human errors and lack of understanding of tax laws. The knowledge of taxpayers has increased, and conflicts with tax authorities can now be easily resolved through effective communication and competence tribunals.[15]

- Although, previous tax regime in Nigeria has been plagued by serious issues, the e-tax system has improved tax compliance and decreased the incidence of tax evasion and avoidance. In addition to incorporating efficiency and transparency into the system, the new integrated tax system offers taxpayers the convenience of paying taxes. It maximizes the collection of tax revenue and promotes taxpayers’ voluntary compliance. The system’s emphasis on accountability gives taxpayers a sense of security that their taxes will be duly utilised when remitted, which greatly motivates them.

- Finally, the system improves the database for taxpayers, enabling the government to collect more taxes by ensuring compliance.[16]

CHALLENGES OF E-TAXATION IN NIGERIA AND THE WAY FORWARD

Although e-tax is intended to be a solution to the majority of Nigeria’s tax administration issues, it faces adoption and implementation issues like any other system.[17]Some of the difficulties include.

- Concerns about trust, security, and privacy are prevalent. Taxpayers are worried about how their personal information will be used. Unauthorized access to taxpayer information can occur in some circumstances, which may constitute a security breach. As a result, many taxpayers worry that their information could fall into the wrong hands and result in fraud. The system is also impacted by the actions of hackers who disrupt websites.[18]

- High rate of illiteracy: Nigeria, sadly, has a low literacy rate and an even lower percentage of computer-literate citizens. As a result, the majority of taxpayers who are not technologically savvy avoid the system and cling to the ‘simpler’ procedures they are already accustomed to. Those who are brave enough to try frequently become victims of scammers and hackers. It has thus become difficult for businesses in Nigeria to understand e-taxation.

- Another main difficulty with implementing the system is the general resistance to change. Because they are used to doing things the way they always have been and do not want to step outside of their comfort zone, the majority of people already have their minds made up that they will not respond to new systems before they even understand what they are about. Taxpayers resisted change when e-tax was introduced, despite the manual tax system’s history of being tedious and challenging. The FIRS was required to arrange several forums and public enlightenment for taxpayers that offered thorough explanations about the e-tax and the advantages it suggests.[19]

- Another challenge is the lack of awareness of the system. Many Nigerians are blissfully ignorant of the possibility of electronic taxation, let alone taking part in it. The majority of taxpaying citizens in the nation’s less developed states are unaware of the introduction of e-tax, which explains the slow and problematic uptake of the system.[20]

CONCLUSION

The legal analysis of the e-tax payment system in Nigeria underscores both its potential benefits and the need for careful consideration of legal and regulatory frameworks. The advent of electronic tax payment has undoubtedly streamlined the tax collection process, increasing efficiency and transparency. It has also improved the ease of doing business in Nigeria by reducing bureaucratic bottlenecks. However, as with any technological advancement, there are legal challenges and concerns that must be addressed to ensure the system’s effectiveness and fairness. Key issues include data privacy and security, electronic fraud prevention, and ensuring equitable access to the system, especially for those without reliable internet access. To fully realize the potential of the e-tax payment system in Nigeria, it is crucial for lawmakers, tax authorities, and regulatory bodies to work together in developing robust legal frameworks that protect taxpayer rights, safeguard sensitive information, and foster trust in the system.

KEYWORDS: e-taxation payment system, tax administration, taxation, revenue generation.

SNIPPET: Government has started several reforms and innovations to increase the collection of internally generated revenue, with taxation receiving the majority of attention.

AUTHOR: Oyetola Muyiwa Atoyebi, SAN FCIArb. (U.K)

Mr. Oyetola Muyiwa Atoyebi, SAN is the Managing Partner of O. M. Atoyebi, S.A.N & Partners (OMAPLEX Law Firm).

Mr. Atoyebi has expertise in and vast knowledge of Tax Law and Practice and this has seen him advise and represent his vast clientele in a myriad of high-level transactions. He holds the honour of being the youngest lawyer in Nigeria’s history to be conferred with the rank of Senior Advocate of Nigeria.

He can be reached at atoyebi@omaplex.com.ng

CONTRIBUTOR: Obiora Ifediora

Obiora is a member of the Dispute Resolution Team at OMAPLEX Law Firm. He also holds commendable legal expertise in Tax Law.

He can be reached at obiora.ifediora@omaplex.com.ng

[1] Igberaese T I, The effect of oil dependency on Nigeria’s Economic growth’ https://thesis.eur.nl/pub/15396/ITracy_l_moodledata_temp_turnitintool_793995179._60_1384335874_2108.pdf accessed, 23rd September, 2023.

[2] IMF, ‘Nigeria’s Tax Revenue Mobilzation: Lessons from Successful countries’ https://www.elibrary.imf.org/view/journals/018/2023/019/article-A001-en.xml accessed 22nd September, 2023.

[3] Ibid

[4] Che-Azmi, A. A. & Kamarulzaman, Y. ‘Adoption of tax e-filing: A conceptual paper. African Journal of Business Management, [2014] 34 p. 599

[5]Wasao, D. ‘The effect of online tax system on tax compliance among small taxpayers.’ [2014]University of Nairobi. www.taxpromax.firs.gov.ng. accessed on 23rd September, 2023.

[6] Ike ER, ‘Impact of E-Taxation on tax administration in Nigeria’ https://icanig.org/documents/19_IMPACT_OF_E-TAXATION_ON_TAX_ADMINISTRATION.pdf accessed, 23rd September, 2023.

[7]Okunowo, A. O. ‘FIRS introduces E-filing Tax System in Nigeria’ https://www. linkedin.com/pulse/firs-introduces-e-filing-tax-system-Nigeria-okunowo-a-obafemi/ accessed 21st September, 2023.

[8]Nasir, J. ‘Implementing electronic tax fillings and payments in Malaysia’ Journal of Accounting and Economics,[2015] 17(2), 41-67.

[9] Umenweke MN, ‘The Law and practice of Electronic Taxation in Nigeria’ https://www.ajol.info/index.php/naujilj/article/view/136245/125735 accessed 23rd September, 2023.

[10] Ibid

[11]Although no express provisions are provided in many of these legislations, the allowance can be inferred in line with the provisions of the National Tax Policy 2017

[12] Rotimi O, ‘E-Tax Administration and Tax Compliance’ https://www.atreview.org/admin/12389900798187/Article%204(3)%2093-101.pdf accessed 23rd September, 2023.

[13] FIRS, ‘e-Tax Payment’ https://www.firs.gov.ng/e-tax-payment/ accessed 22nd September, 2023.

[14] Ibid

[15] World Bank, ‘Taxes & Government Revenue’ https://www.worldbank.org/en/topic/taxes-and-government-revenue accessed 23rd September, 2023.

[16] Ibid

[17] Oluwatobi O, ‘Nigeria’s Electronic Tax Compliance System: So Far, So Good’ https://www.mondaq.com/nigeria/withholding-tax/1163892/nigerias-electronic-tax-compliance-system-so-far-so-good accessed 22nd September, 2023.

[18] Ibid

[19] International Monetary Fund (IMF), ‘Tax Policy for developing countries’ https://www.imf.org/external/pubs/ft/issues/issues27/ accessed 23rd September, 2023.

[20] Ibid