Economic Issues

Nigeria And Marginal Fields: The Way Forward -By Luqman Adamu

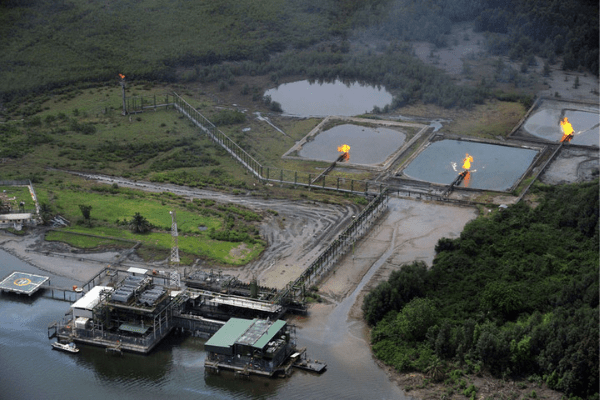

Nigeria had its first marginal bidding round in 2003 where 24 licenses were awarded to 31 companies (17 to sole operators and 7 to joint ventures). This increased local players’ participation in the Oil and Gas sector and also birthed some strong local and regional African E&P companies.

Nigeria is blessed with a huge reserve base of oil and gas with over 1,000 discovered (undeveloped) oil fields, but with less than 40% production level on available acreage. You can conclude the country’s oil and gas sector is one big conundrum.

One hugely successful upstream local content development strategy for Nigeria since the early 2000s has been the Marginal Fields Licensing Rounds.

Before we delve any further, let’s expand on what is termed a Marginal Field.

According to Peter (2001) “Marginal field has been defined as a field which given economic situation is unprofitable”.

Another definition from the Guidelines on farm-out and operation of Marginal Fields (2013) defines marginal fields to be “any Field that has reserves reported annually to the Department of Petroleum Resources (DPR) and has remained unproduced for a period of over 10 years”.

But The Petroleum Act of Nigeria 1996 gives the President the power to label oil fields as ‘Marginal’. The Act’s paragraph 16A defines Marginal Oil Fields as “such fields as the president may from time to time identify as marginal”.

The Nigerian Association of Petroleum Explorationist (NAPE) defines marginal fields as, “non-producing fields whose economics is not considered robust enough using conventional development methods under the prevailing fiscal regime”.

From the above definitions, we can conclude that factors that determine the marginality of any field depend on its location, technological and environmental constraints, size of the reserve, price stability and other factors that may affect the functionality of a field.

The first Nigerian Marginal Field to be farmed out was the Ogbelle Field, farmed out by Chevron Nigeria Limited in 1997, but the field was not formally acquired until 2000.

Nigeria had its first marginal bidding round in 2003 where 24 licenses were awarded to 31 companies (17 to sole operators and 7 to joint ventures). This increased local players’ participation in the Oil and Gas sector and also birthed some strong local and regional African E&P companies.

The second bidding round was announced in 2013, this would have seen 31 licenses awarded for the 31 marginal oil fields put up on the offer, but it never happened.

On the 1st of June, 2020 the Nigerian Department of Petroleum Resources (DPR) announced the launch of a new bidding round for 57 marginal fields (onshore, swamp and shallow-offshore terrains) made available.

Marginal Oil Fields license bidding has many advantages to the development of the oil and gas sector and the economy at large;

• A source of revenue for the Federal Government

• Increased local participation, hence creating job opportunities.

• Maximizing production capacity

• Diversification of oil production sources

• Increases oil and gas reserves, thereby preventing waste.

But there is a problem, between 2015 and 2016, marginal oil field production contributed a meager 3.05% to crude oil output. Also according to the Nigeria Natural Resource Charter (NNRC) through its Benchmarking Exercise Report (BER) for the years 2012-2019, the end to end operations of allocating Nigeria’s rights have shown no significant change as documented in Precept 3 (which talks about Exploration, Licensing, and Monitoring Operations) under which the case of Marginal Oil Fields fall.

So, this asks the questions “what is wrong? “and “what is the way forward?”

WHAT IS WRONG?

The NNRC’s 2019 BER identified the following issues

1. Discretionary powers are still retained by the Minister of Petroleum (which is the president) over licensing rounds.

2. Data is not made public, and this makes monitoring operations difficult.

3. Absence of Pre-licensing EIAs (Environmental Impact Assessments).

4. Abuse of the license transfer process.

5. The Government still has stronger negotiation powers.

WHAT IS THE WAY FORWARD?

According to Mr Auwalu Sarki, 600 companies have applied to be pre-qualified for the ongoing bid rounds. He further stated that to auction an oil field, you need to get at least 10 companies per field. So having 600 companies’ applications should be seen as a success, but considering no changes has been made from the previous bidding round processes, it might be too early to consider it a success.

For starters, the passage of the Petroleum Industry Bill (PIB) before now would have definitely addressed some of the problems by whittling down government power/influence, placement of stringent license transfer process, introduction of Pre-licensing EIAs amongst others.

Seeing that half of the fields awarded previously have ended up being undeveloped thereby contributing little to no financial returns to Nigeria’s Economy coupled with the state of the economy owing to Covid19, Nigeria cannot afford to repeat previous mistakes and the PIB is needed to ensure the productivity and efficiency of awarded fields.

It is also worth noting that Industry players are also unsure of what to expect as the uncertainty around the PIB has caused some investors to delay projects.

NNRC’s BER 2017 states that “Precept 3 enjoins government to encourage efficient exploration and production operations, and allocate rights transparently.” The Report discovers that laws, policies, and practices reveal the absence of strategic impact assessment and poor disclosure of exploration and licensing information.

From the above, we can deduce that an efficient exploration and production operation coupled with transparent allocation of rights will be a welcome step forward.