National Issues

As Loan Sharks Resort To Collecting Bank Customers’ Data From Digital Waters, It Is Expedient For Authorities To Fish Them Out -By Sandra Ijeoma Okoye

NAN reports that the NDPR mandates organizations to carry out due diligence before engaging in any data processing, explaining that this is to ensure that parties are accountable for any infringement on fundamental rights and freedoms of data subjects.

There is no denying the fact that debt has long been a collective pain in the neck for many Nigerians, but the unprecedented problems have spread to the point where most Nigerians can no longer bear the misery. For instance, the COVID-19 pandemic and its aftermath created enormous upheaval in the lives of not few Nigerians so much so that their health, their jobs, and their financial security are been threatened. As if the misery thrown upon virtually everyone is not enough, more recently, soaring inflation and spiraling prices of foodstuffs even up to bread that used to be a giffen consumer item has surprisingly become an ostentatious item. In fact, the level of hardship coupled with hunger in the land is so bad that woes are been piled upon crisis, upon uncertainty, so much that it has unbearably become worrisome.

No doubt, the unarguable austere situation has pushed not a few people into stress, anger, depression and anxiety. Without any iota of exaggeration, the emotional strain of dealing with debt can be almost damaging as it is increasingly becoming common place to see a debtor’s electricity cut off or having his or her car repossessed or seeing his or her bank account plunged to the depth of getting another loan. Not only that, trucks conveying personal property of people are becoming ubiquitous on roads and streets as tenants are increasingly been evicted from their apartments for inability to pay their rents.

At this juncture, permit me to maintain the principle of Respondent Anonymity Assurance (RAA) in this context, meaning that the identities of survey participants in the course of gathering materials for this write-up will not be disclosed so as to be able to get honest answers without worrying about the repercussions when I approach them in the bid to write future article such as this.

Against the backdrop of the foregoing permission granted yours sincerely, it is expedient to narrate that Mr. X was in dire need of money to support his family when the COVID-19 pandemic struck in 2020 and restrictions and lockdowns came into effect in Lagos.

He chanced upon a digital promotion on his phone by a private online lender offering easy loans. He just needed to download an app to apply. He said that he then received a loan of 5,000 naira that was required to be paid back in full plus 60% in interest within two weeks.

But when the repayment was due, Mr. X’s phone crashed and he couldn’t access the app. The online lender then blacklisted him.

Mr. X said, “They actually spoilt my image, they were actually reaching out to my contacts telling them that I am a criminal, telling my family and friends that I am a scammer, a thief, and that I have gone away with their money.”

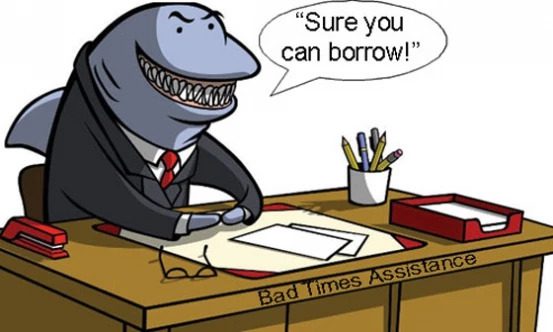

Without any iota of exaggeration, many Nigerians have had to take loans from unscrupulous online lenders, popularly called loan sharks, particularly now that the wobbling economy with its attendant hardships are biting harder. Those with no means to earn a living had no option than to accept exorbitant interest rates, and unfortunately, the loan sharks they turned to were mostly Chinese-owned.

In the same vein, Mr. Y was desperate for quick cash to buy drugs for his ailing mother. He had no savings to spare. He downloaded a lending app, and applied to get N8, 000 to buy drugs for his mother to which his account was credited few minutes later, but the loan agreement terms stipulated he would return the loan within seven days.

On the fifth day, Mr. Y decided to seek an extension beyond the agreed date for payment after his mother died in the hospital. Surprisingly, he got a rude shock when he explained his ordeal to the loan officer, who unsympathetically rejected his request and threatened to share information about his debt with friends and members of his family on his phone contacts.

At the due date, the debt officer made good on his promise. He sent messages to Mr. Y’s friends, relatives and office colleagues saying he was a fraudster and had defrauded the money-lending company. The regret of losing the trust of close friends and relatives sent Mr. Y into a downward emotional spiral.

Considering the threat which loan sharks have posed to hapless and desperate borrowers across the length and breadth of the country, it is expedient for the leadership of the Central Bank of Nigeria (CBN) to literarily fish out the offensive loan sharks from the digital waters that is by each passing day becoming deeper and deeper. The reason for this call cannot be farfetched as it is not an exaggeration to say that for a money-lending firm or financial company to legally operate in Nigeria, it must obtain a license from the apex bank.

At this juncture, it is expedient to mention the fact that the Federal Competition and Consumer Protection Commission (FCCPC), the Central Bank of Nigeria (CBN) and the Economic Financial Crimes Commission (EFCC) are not resting on their oars as they were sometime ago reported in the media to have commenced rights violation investigation into the money lending industry. Particularly of mention in this context is the leadership of FCCP which has been at the forefront of the battle by pragmatically clamping down on unregistered shark loan operators that were equally found to be involved in adopting guerilla style to recover loans granted to borrowers.

It would be recalled in this context that FCCPC in the month of March this year in a well-coordinated operation spearheaded raided Offices of loan sharks in Lagos over consumer rights abuse.

At this juncture, it is expedient to say that what inspired yours sincerely to express this view now, even if it was been prepared for future publication, is the news that emanated today from the News Agency of Nigeria (NAN) that UBA and Phillips Consulting are under probe over violation of data regulations.

As gathered from the news source, NAN, the National Data Protection Bureau (NDPB) is investigating Phillips Consulting firm and United Bank for Africa (UBA) PLC for alleged violation of the Nigerian Data Protection Regulation (NDPR).

The news agency reported that the National Commissioner of the NDPB, Dr. Vincent Olatunji, said the commencement of the forensic investigation was in line with Article 4 of the NDPR.

“The complaint against Phillips Consulting is in connection with the activities of online lending platforms who willfully breached the privacy of citizens.

“The investigation of UBA Plc pertains to allegations of infringement on the governing principles of data protection,” Olatunji said.

NAN reports that the NDPR mandates organizations to carry out due diligence before engaging in any data processing, explaining that this is to ensure that parties are accountable for any infringement on fundamental rights and freedoms of data subjects.

The Bureau, however, warned all data controllers and processors to eschew all forms of data processing detrimental to citizens as well as the economy and security of the country.

For the sake of clarity, Phillips Consulting is a firm that provides transformation, technology and outsourcing services while UBA provides corporate, commercial, SME, consumer and personal (retail) banking services to more than 27 million customers, served through diverse channels, and has over 1,000 business offices and customer touch points with 2,669 ATMs, 87,223 POS, and robust online banking services with all its consumers’ data in its digital repository.

Given the foregoing, it is expedient to urge authorities charged with the responsibilities of ensuring sanity on online lending market to fish out loan sharks that have resorted to be conniving with banks toward the collection of bank customers’ data from digital waters.